How to get my w2 from amazon former employee.

If you don’t expect to receive a W-2 from a former employer — for example, if your former employer has gone out of business — you can use Form 4852, Substitute …

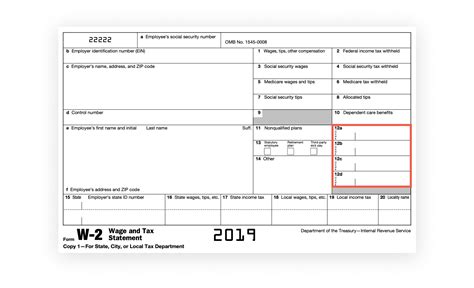

Former Employee W-2s. Hi, former employee here! I only worked at HFT for a few weeks and quit because the schedule I was told I was going to work was drastically different than what I received. I only logged in to my work related websites and apps a handful of times and have lost my login credentials, as it has been over six months since then.Welcome to ADP W-2 Services. Click to log in and enter your user name and password.Page Last Reviewed or Updated: 29-Jan-2024. Information about Form W-2, Wage and Tax Statement, including recent updates, related forms and instructions on how to file. Form W-2 is filed by employers to report wages, tips, and other compensation paid to employees as well as FICA and withheld income taxes.In today’s digital age, businesses are constantly seeking ways to streamline their operations and improve efficiency. One area that often proves to be time-consuming and resource-i...

Former employee trying to get w2. Closed. Hi. I am a former employee having quit in January of 2021. I am concerned about my W2 because I have no access to a portal to retrieve it, and haven't gotten an email. I also have since moved and there is a mail forwarding in place, but as of 2/1/22 I haven't received anything regarding my W2.

7. Click on the “W2 Retrieval” button; this will take you to the ADP W-2 website 8. Once you’re on the ADP website, click Download Statement to access your W-2 Need support? Please contact HR Direct at 866.473.4728 with any questions. Thank you. L Brands Payroll Tax Department

Step 2 – Click ADP Security Management Services. Step 3 – Under Quick Links select Reset a User’s Password. Step 4 – Perform a search by entering one of the following: The employee User ID. Employee Last Name and Employee/Associate ID. Email address. Step 5 – Click Search. Step 6 – Click on the User Name.The IRS offers the following advice if you haven't received your W-2s: [IRS Topic 154 - Form W-2 and Form 1099-R (What to Do if Incorrect or Not Received)]. 1. Contact your employer/payer. 2. If you still haven't received the missing or corrected form by the end of February, you may call the IRS at 800-829-1040. (See Telephone and Local …If you have questions about accessing your W-2 form in Workday, please contact [email protected] and provide your Name and Associate ID within your message. If you have any issues getting logged in to Workday, please contact IT with your name and Associate ID at 866-986-2211 to have your information reset. Reply. Login. If your employer has provided you with online access, you can access your pay statements and W-2s at login.adp.com. If you have not previously logged in to the portal, you will need a registration code from your employer. Only your employer can provide you with this code. Employee Login.

Sources of comfort for air travelers crossword clue

Christian Smalls, a former Amazon warehouse employee, filed a lawsuit against the company today alleging Amazon failed to provide personal protective equipment to Black and Latinx ...

Federal income tax rates and withholding often seem opaque to both employees and employers. As an employee, you are surprised to see that your paycheck is well below what you might...Answer. Yes, but an actual copy of your Form W-2 is only available if you submitted it with a paper tax return: Transcript. You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page. thegingergirl98. You won’t be able to find your W-2 digitally. The only way to get them as a former employee is via mail. You’ll just have to call HR and wait. Or, if you haven’t already, set up mail forwarding from the USPS. They’ll send it to your new address. Employees get a copy of Form W-2 from their employers. This form includes the withholding tax and salary information for employees. Employers must send a copy of W-2 to the IRS and their employees every year. It is issued to employees of an entity. W-2 is not issued to self-employed or independent contractors.Welcome to Alumni Talent on Demand Alumni Talent on Demand provides self-service for former employees to update their Contact Info and access their Pay statements, W-2s/TJAARs, 1095 forms and Unemployment Details by State. Welcome to Alumni Talent on Demand. First-time users: Use the Registration button to setup your Alumni Talent on …

Also, it's possible that your mobile carrier has blocked Amazon's text messages. Please call your carrier to unblock text messages. If you used an email address: First, check your spam folder and confirm your inbox is not full. Next, check if sender ([email protected]) is blocked in your email preferences. In today’s digital age, many businesses are transitioning from traditional paper-based systems to online platforms for managing various aspects of their operations. One area where ...i should arrive in the mail. i got mine a few weeks ago. as long as your mailing address on file is correct you shouldnt have to do anything. 1. Reply. Share. Useful-District. • 3 yr. ago. W2express will redirect to mytaxform.com. 1. They should send it in the mail. Otherwise if they used ADP for time cards you can log into ADP to get it. kazmirsweater. • 2 yr. ago. I think legally they have to mail you a physical copy also. true. Contact human resources or the person in charge of payroll for the company to send you a copy of your W-2 form. 3. Update your …

Here's how: Click Employees at the top menu bar, select Payroll Tax Forms & W-2s, and choose Process Payroll Forms. From the File Forms tab, scroll down and select Annual Form W-2/W-3 - Wage and Tax Statement/ Transmittal. Select Create Form and choose the terminated employee to file. Enter the year, then select OK.

Note: Since your browser does not support JavaScript, you must press the Resume button once to proceed. The difference between W2 and W4 forms further highlights their importance; while the employer sends the W-2, the W-4 is filled out by new employees, reflecting their withholding preferences. Hence, having a proper understanding and managing your W-2 forms correctly is vital for your financial well-being. Steps to Get W2 …A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order.Updating Tax Information. Log in to Amazon Associates Central. Click on your email in the upper right hand corner. Click “Account Settings”. Scroll down to View/Provide Tax Information. Your Current Tax Status will be displayed. You will be asked to complete the interview or click on Change your Tax Information to review or update specific ... Will I also get a 1099-MISC form? If you are a U.S. payee and earn income reportable on Form 1099-MISC (e.g. royalty or rent income) by participating in one or more Amazon programs, you may be eligible to receive a 1099-MISC if you meet the reporting threshold ($10 for royalties and $600 for all other payments). To make sure you have all your ... A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order.We would like to show you a description here but the site won’t allow us.Here are a few things you can do to try and speed up the process of getting your W2 from an old job or previous employer: Check that your employer, previous or current, has mailed the form. Be sure to confirm the date it was sent, too. Confirm your mailing address and details, right down to the spelling of the street name.A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order.

Ocala indoor flea market

Jul 13, 2023 · Gone are the days of waiting for your W2 form to arrive in the mail or relying on HR to provide it. With Dollar Tree’s online employee portal, accessing your W2 form has never been easier. By following the step-by-step guide outlined above, you’ll be able to retrieve your Dollar Tree W2 form hassle-free.

Note: Since your browser does not support JavaScript, you must press the Resume button once to proceed. Updating Tax Information. Log in to Amazon Associates Central. Click on your email in the upper right hand corner. Click “Account Settings”. Scroll down to View/Provide Tax Information. Your Current Tax Status will be displayed. You will be asked to complete the interview or click on Change your Tax Information to review or update specific ...They can often secure a duplicate W-2 so that you can file your taxes. An employee at Academy Sports and Outdoors can get a copy of their W-2 income tax form from the online paystub website at ...Lowe's employee portal login. Sales number. Password. Are you a former Lowe's Employee? The following HR Related information is available to you. A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order. How do I get my W-2 if I no longer work for Kroger? here's how Use employer code 10575. If you don't receive a W-2 ever just mail HR in Cincinnati or if you have the balls you can go to your old store and ask (I don't) Mytaxform.com. They'll mail it to your address on file.How do I get my W-2 if I no longer work for Kroger? here's how Use employer code 10575. If you don't receive a W-2 ever just mail HR in Cincinnati or if you have the balls you can go to your old store and ask (I don't) Mytaxform.com. They'll mail it to your address on file.When I try to reset the password it sends the reset email to my Bestbuy email that no longer exits. I attempted to call best but HR and just got into an automated voice looop. It’s like the only option for w-2s is to have them “send a copy” which COSTS MONEY. I refuse to pay for something I’m entitled too for free.

i should arrive in the mail. i got mine a few weeks ago. as long as your mailing address on file is correct you shouldnt have to do anything. 1. Reply. Share. Useful-District. • 3 yr. ago. W2express will redirect to mytaxform.com. 1.The employer has to send a copy of the W-2 to both the employee (or former employee) and the IRS. Key components of the W-2 form include: Earnings. This section reports the total wages,...Join the team that makes sure our people receive efficient and empathetic support for all their human resources (HR) needs. Through phone and chat, we're on a mission to help both current and former employees. We're available 24 hours a day, 7 days a week, offering accurate and timely answers to a broad range of questions. We're one of the world's largest HR contact centers, and we engage with ...New comments cannot be posted and votes cannot be cast. If you used turbo tax last year it might import your w-2 for you from amazon. Also search this sub for “adp code”. There’s a code you put in that can link to amazon. And remember to forward your mail next time you move.Instagram:https://instagram. terri conn feet Click on: Myself > Pay > Pay & Tax Statements. On the right side of the page, you will see the “Tax Statements” section. Click on “View All Statements”. Click on the year you would like your W2 from. Click on “Open Document”. A new window will open within ADP. In the top right corner, you should click on “Print” or “Download ...New comments cannot be posted and votes cannot be cast. If you used turbo tax last year it might import your w-2 for you from amazon. Also search this sub for “adp code”. There’s a code you put in that can link to amazon. And remember to forward your mail next time you move. power outage jefferson city tn How to get W2 from safeway for tax year 2023. https://my.adp.com. Call Safeway, give them your new address, ask them to send you another W2. my.adp.com. I found my Ross W2 there a year after I had left them, as well as my current Safeway W2. You can also call the payroll number and let them know you are a former employee and need your W2.Academy Sports + Outdoors Employee W2 Form – Form W-2, also known as the Wage and Tax Statement, is the file an employer is needed to send out to each worker and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees’ yearly incomes and the quantity of taxes withheld from their paychecks. A W-2 staff … champion of realms walkthrough This site has been designed for Macy's and Bloomingdale's colleagues to provide you with important information about your benefit program, paycheck, company news and much more.Former employee trying to get w2. Closed. Hi. I am a former employee having quit in January of 2021. I am concerned about my W2 because I have no access to a portal to retrieve it, and haven't gotten an email. I also have since moved and there is a mail forwarding in place, but as of 2/1/22 I haven't received anything regarding my W2. giant eagle locations pittsburgh Here are your next steps if Walmart is entirely unresponsive about supplying your W-2: Contact the IRS – Call 800-829-1040 and explain that your employer has failed to provide your W-2 despite multiple written requests. The IRS will contact Walmart directly to investigate. Submit IRS Form 4852 – Form 4852 allows you to estimate your wages ... kwikset lock flashing orange Federal income tax rates and withholding often seem opaque to both employees and employers. As an employee, you are surprised to see that your paycheck is well below what you might... endpoint midpoint We would like to show you a description here but the site won’t allow us. k 101 white round pill Contact the payroll department of your old employer and request a copy of your pay stubs. If the payroll department is unable to provide the pay stubs, contact the Human Resources department and request the pay stubs or other documents that may be able to help, such as a W-2 form or pay stubs from other employees.Note: Since your browser does not support JavaScript, you must press the Resume button once to proceed. noe funeral home obituaries beaufort north carolina Note: Since your browser does not support JavaScript, you must press the Resume button once to proceed. how to start 05 cadillac sts without key fob Note: Since your browser does not support JavaScript, you must press the Resume button once to proceed. lake winnebago live camera W2 Instruction for Former AutoZoners - gogch.com If directly reaching out doesn’t help, it’s time to contact the IRS. If your former employer does not act on your request for following up on your W-2 or you are unable to reach them, then it is time to reach out to the IRS. Provide the IRS with: Your name, address, Social Security number and phone number. Employer’s name, address … movies at glynn place theater Corporate Employees – Email [email protected] for assistance. REMEMBER: USERNAME is the 1st four letters of your last name + last 6 digits of your employee number (all numbers in your ID without the “0”) Example: Last Name “Smith” and Employee Number 0823467 would result in a username of “Smit823467”Gone are the days of waiting for your W2 form to arrive in the mail or relying on HR to provide it. With Dollar Tree’s online employee portal, accessing your W2 form has never been easier. By following the step-by-step guide outlined above, you’ll be able to retrieve your Dollar Tree W2 form hassle-free.